Basic Understanding how Fractional Banking Works

Let’s present a scenario that is familiar to just about every adult. You go to the bank, deposit a physical check or stack of cash into the ATM or a cashier’s waiting hands.

And…that’s likely the furthest you think about the matter.

But have you ever stopped to consider where the contents of that specific deposit go?

Many customers envision their digital “account” being replenished with more funds, but does a physical equivalent of your digital “account” actually exist?

No, at least not as you may imagine it to. This is the case, in part, because of a financial system that allows for fractional reserve banking (more on this in a bit).

Despite banks holding far less of their customers’ money than most realize, a substantial portion of the public believes that the precise amount of money in their account is being held in some physical space.

Extrapolate this view to the totality of customers who have a checking and/or savings account at any bank, and you may believe that banks hold all of their customers’ funds in a physical vault, ready for withdrawal at any moment.

Fractional Banking Means Banks Only Hold a Fraction of Deposits

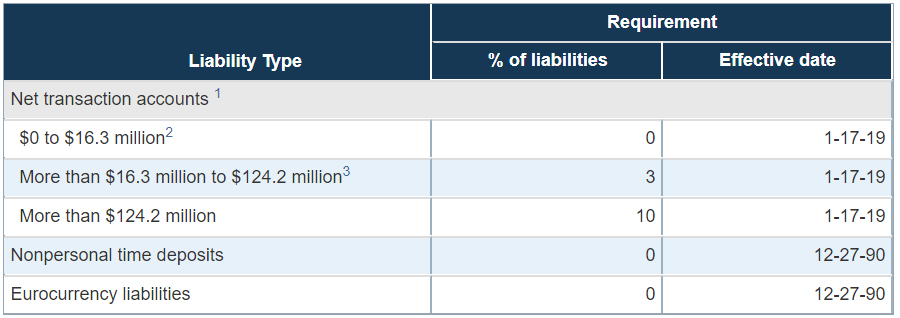

Banks holding between $16.3 million and $124.2 million in customer deposits, however, must only hold 3% of their deposits in their physical reserves.

With these figures in mind, we found that just 9% of respondents to our study fully understand how much money their bank needs to hold in their reserves at any given time, while most respondents (43%) admitted that they did not know how much a bank must hold.

Ultimately, a better understanding of fractional banking means that Americans will better understand where their money is most likely to be at any given moment.

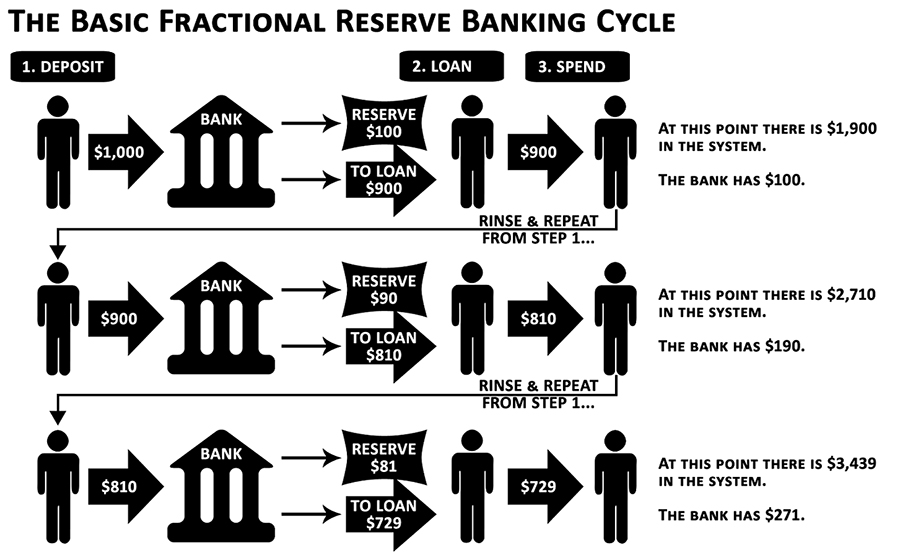

This method above can repeat until over and over again …

Now you deposit $729 Bank reseves $72.9 To Loan Balance $656.10

accumulate Loans Created $4,950.10 and now the bank is holding $343.90

You get the picture. Its the reason why Global Resource Broker works in Bank instruments so we can allow our clients to play inside the bank rules.

Here’s a basic breakdown of how the multiplier effect works:

Bank A lends out the 90% of its deposits that it is legally allowed to to Bank B. Bank A’s accounting books still show that it possesses 100% of those deposits, even though they only physically retain 10% of them.

By the same token, Bank B adds the borrowed funds, equivalent to 90% of Bank A’s deposits, to their balance sheet. It does not count the borrowed money as debt, but instead as current assets that it may re-lend out, collecting interest of their own. After all, they can lend that borrowed money out, and they can collect interest on those loans.

In this way, the amount of money in circulation “multiplies” — one could not be blamed for mistaking this effect with magic — with that exponential multiplication creating direct ramifications.

The ramifications cut both ways.

As the money supply grows, consumers should theoretically have greater access to credit, with easier borrowing serving as an economic stimulus. But it’s also the case that the more the money supply grows, the lesser the value of each individual dollar.

In other terms, purchasing power declines. This is why fractional reserve banking and its net effect remains a polarizing topic.

The federal reserve updated its reserve requirement table in January of 2019. They ruled that all banks with more than $124.2 million in deposits must maintain 10% of their deposits in their physical reserves. That 10%, or 1/10th, is the ‘fraction’ of customer deposits that banks must, by law, keep on hand.