BITCOIN ETF – WHAT IS IT AND WHY IT HAS HELPED INCREASE THE PRICE OF BITCOIN

The eight-year-old crypto-currency is still a big unknown for many, and it’s a very small asset class in Wall Street’s eyes.

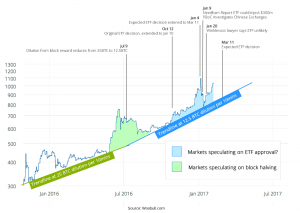

Yet this could all change very soon, as bitcoin may soon be available to investors via an Exchange-Traded Fund. In fact, the Securities and Exchange Commission (SEC) is slated to decide this week whether to green-light a new bitcoin ETF. This would give investors much easier access to the price moves in the digital currency. Ironically, the moves of late in the price of bitcoin have been fueled by the prospect of the SEC approving a bitcoin ETF. And this has caused the value of bitcoin to surge to record highs.

Moreover, one bitcoin now is worth more than one ounce of gold.

According to an article in today’s Wall Street Journal:

An ETF could serve as a bridge from bitcoin’s current status as a counterculture technology to mainstream acceptance. Now that’s what I call an alternative investment. I’ve been interested in bitcoin from not only an investment perspective but also from a societal perspective, for a long time. And though the cryptocurrency has been around for years, it’s not an easy thing for the average investor to gain exposure to.

An ETF would change all that, making bitcoin as easy to own as the S&P 500. What makes bitcoin such an alternative investment? Well, not only is it not correlated to stocks or bonds, it’s not really correlated to any other currencies either. That’s because it’s a digital currency that’s not backed by any government. Instead, bitcoin is “mined” or created by computer programmers. It essentially exists on a global network of computers.

I know it sounds somewhat bizarre. And it is, to some extent. Yet the idea of a bitcoin ETF is far from bizarre … and could very well be a reality thanks to the Winklevoss twins.

The Winklevoss twins, Cameron and Tyler, are the men who thought up the initial idea of the social media network that later became Facebook (FB)

Indeed, the brothers are actually best known for their battle with Mark Zuckerberg over the creation of Facebook, as all three were classmates at Harvard in 2003. That’s when the twins enlisted the computing acumen of Zuckerberg to help with their new social media website, ConnectU.

By 2004 Zuckerberg had parted with the twins and launched Facebook. The Winklevoss brothers then sued Zuckerberg for essentially poaching the idea. The men settled the lawsuit, with the Winklevoss twins reportedly receiving a sum of at least $65 million.

Now, the brothers are the brains and the financing behind the bitcoin ETF, which they are trying to get approved by the SEC. Their Winklevoss Bitcoin Trust, with a proposed ticker symbol of COIN, would be listed on the Bats exchange.

Per the WSJ:

Under the SEC’s application rules, a decision is expected on the trust by Saturday. The commission could approve it, reject it outright, or leave a window open for a rejiggered application. A spokesman for the agency declined to comment.

Which way the SEC goes is unclear. But the Winklevoss bitcoin ETF idea has been on the runway before … and failed to take flight. Our resident ETF expert, Grant Wasylik, told me that he attended the “Inside ETFs” conference in January 2015. The Winklevoss twins had their own session at that event, which he attended. They had filed for a bitcoin ETF back then, and they were optimistic about approval “soon.”

I remember one of the twins saying: “If you like gold, you should like bitcoin. It’s more portable … it’s more divisible … it’s harder to seize … and it will have more controls (regulation framework).”

Well, now one bitcoin is worth more than one ounce of gold, and it’s getting that much closer to SEC approval.

If it gets approved in ETF form, it should be a big win for bitcoin. That’s because it will open the digital currency to the masses. Anyone with a brokerage account will be able to invest in it without the challenges of buying and storing it.

The supply-demand situation is further worsened by the hopes of Bitcoin ETF’s approval on March 11, 2017. People, both existing cryptocurrency community members, and other investors are increasingly buying into the digital currency as Bitcoin’s price is expected to increase even further. According to few media outlets, Bitcoin ETF’s approval will see Bitcoin’s price rising to $3,200 — more than double the current price.

Another active market for Bitcoin lies in Japan The Japanese government has already imparted Bitcoin with the status of a legal tender. The relevant regulations are expected to enter into effect later this year. The digital currency’s legal status in the country has also boosted cryptocurrency- related activity in Japan.

All these things put together shows that the rising Bitcoin price is due to multiple factors and any effects, positive or negative will become visible by mid-march.

Other factors attributing the rise of Bitcoins price.

Like any other tradable asset, Bitcoin price is also bound to speculation. At the same time, various other factors drive the demand and supply of the digital currency. Until now, the increased trade volumes in the Chinese Market was one of the driving factors behind Bitcoin’s price. However, the recent crackdown on cryptocurrency exchanges by the country’s central bank has led to a significant decrease in Bitcoin trades in the Chinese market.

With almost all leading Chinese cryptocurrency exchanges freezing Bitcoin withdrawals, the number of people trading on these platforms has reduced, resulting in a fall in the cryptocurrency’s supply to meet the international market’s demands. This, in turn, is influencing the rise in Bitcoin value.